How to Create a Usage Based Commission Plan

Usage Based Commission Plans are fast becoming a topic of hot discussion in the Cloud space as Sales teams and Managers try to balance how revenue is earned against how salespeople are paid.

The value and appeal of Usage Based Commissions is obvious. Companies can better manage risk on contracts that may never fulfill their expected values, and Sales can offer different kinds of contracts to customers that increase their ability to close deals and earn their commissions.

So, what is Usage Based Commission? How does it work? How does a company know if Usage Based Commission is the right fit for their needs?

What is Usage Based Commission?

The general idea behind a Usage Based Commission plan, or UBC, is simple. Commission is paid based on what a client uses of a service. For example, think of your electric plan. You are billed based on a specific amount of electric usage over the month. The amount you pay each month to the electric company varies because of your usage, even if the amount per electrical unit (kWh) is the same over the term of your contract.

The difficulty in planning out commission for contracts with varying value based on usage is that the total contract value can’t be known until the end of the contract. Paying a commission on estimations of what earned revenue will be can result in clawing back payments from a salesperson if value was overestimated; or paying some lesser amount now and truing it up at a later date. Nobody likes a claw back, but True Ups can make some sales teams feel like their money is being held by the company for too long.

Commission is paid based on what a client uses of a service. Think about your utilities: electric, water, and gas. Commissions based on expected usage could be problematic if customers don’t use anywhere near that value.

How do you payout commission on billings, if you don’t know how much service the client will be using in advance? How do you balance the missing information to calculate commission, and appease the concerns of the sales team as they anticipate their incentive payout?

How Usage Based Commission Works

Usage Based Commission, or UBC, is more complex because you need to have the ability to determine at least one of the following:

1. Historical data of past usage, even if it wasn’t with your solution.

2. A statistical method to accurately and reliably model usage over a contract term length.

To illustrate this, we’ll assume in the example we are using a statistical usage model because what we are selling is brand new to the market and no usage history is available.

Example 1: Your quota is 1,000,000 usage units (uu) annually. The Expected Average Value of the 10 contracts you sold is 100,000uu each per year.

Your base commission per realized unit is $0.1, and your multiplier is 1.1x if the realized units exceed quota during the contract term. Your company and team have indicated a willingness to have true-ups at the end of the year, so long as some agreement can be made on payouts during the year.

Your Data Science group has put together a customer model that shows clients who expected to use 100,000uu have a standard normal distribution.

1 standard deviation for this group is at 10,000uu, and they tell you with confidence that 99.7% of all 100,000uu contracts will hit between 2 standard deviations. Your data science group has done a good job!

For the moment, we are going to artificially limit the complexity in the example. We are going to treat all contracts as starting in Q1, and new business and retention business are not differentiated.

The Commission Structure

On a per realized unit basis then, UBC could be easy.

You could just wait until the end of the year, get the total amount of usage, and pay that amount exactly. Close the browser. Walk away from the computer. Take a break and enjoy a zesty beverage.

Except, this comes with major flaws.

Commission payout on an annual basis won’t work for most sales organizations. Telling a sales team they will be paid commission at the end of the year is going to cause a mutiny and tank your revenue stream. Fortunately, there are ways to avoid walking the plank.

In this example, assume everyone has agreed that commissions are paid out on a quarterly basis. We then need to be able to rapidly calculate at the end of the quarter the total amount that billed in a quarter across all contracts eligible for commission. Our billing system must be able to accurately spit out usage between time periods, even if those time periods are not the same as invoiced time periods.

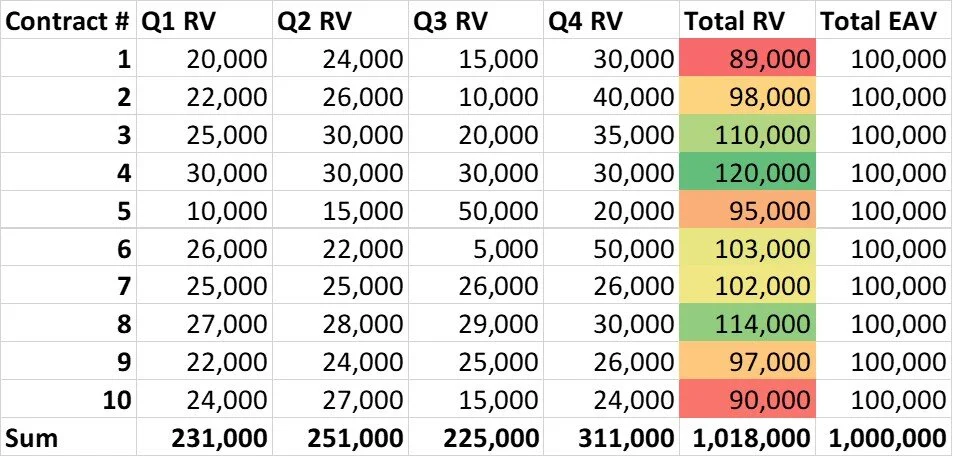

Let’s take a look at Figure 1 below.

Figure 1: Usages of 10 contracts in Usage Based Commission Example

A few immediate observations:

1. Multipliers won’t hit until the end of the year.

2. No contract hits exactly the expected value. Our data science team was right though, we have had no contracts that hit below 80% of the expected value over the course of the year.

All of this leads to one of two possibilities for a simple Usage Based Commission structure.

Quarterly Payouts With EOY Bonus

Each quarter, the Realized Value is paid out, tracked against Quota.

Amounts over quota are then paid out at the multiplier rate.

In the above example the salesperson would have been paid $23.1k, $25.1k, $22.5k the first three quarters. $29.3k in the fourth quarter to bring them up to quota, and an additional $1980 to close them out, for a total of $101,980 for the year.

If our firm agrees that we can properly align behavior without significant risk to us by paying out on contract flow, we have an additional method we could explore.

2. 80% + True Up

The sales team member is paid a commission of 80% of the Expected Average Annual Value of the contract, which should be right at 2 standard deviations lower than the mean in this particular instance.

At year end, a “true up” is done to bring the payments in line with the realized value of the contract.

Any realized amounts over quota are then also paid at the multiplier rate.

In the above example, the Salesperson would have been paid $80,000 “on flow” (when they actually start using), $20,000 in EOY True up to Quota, and an additional $1980 for the 18,000uu that went over quota, for a total of $101980 commission for the year.

The full commission amounts are the same. The bonus amounts are the same. What differs is the timing of payments, and the amounts of each payment.

Are there other UBC models?

Yes, absolutely.

Broadly speaking, the more usage history you have, and the more accurate the models used become, the more targeted your contracts and UBC plans can become to provide maximum value for your clients, your sales team, and your company.

Is Usage Based Commission right for my company?

Usage Based Commissions aren’t for everyone. Beyond requiring historical usage or statistical models, there are unique aspects that must be addressed in Usage Based Commission planning.

Are future start date contracts common in your business? Is it common to have a contract signed today that will not start service for several periods?

Are contract cancellations common either during service, or before starting service?

Do you have a month-to-month option for your services?

Do you sell multi-year contracts, or is it a yearly renewal?

Is the average tenure of your sales team less than the average tenure of your contracts? If so, will this cause misalignment trying to implement a plan that sales teams won’t sell under?

All of these will affect your ability to either do Usage Based Commissions at all, or what style of UBC your company will adopt.

How to put it all together?

Start with reviewing your ability to either get actual usage history, or model usage behavior and look for definable ‘buckets’ of customer types. Not only will this help with commission planning, but may also help for pricing and margin calculations elsewhere in the revenue organization.

Work with Finance and Legal to see if there are Cash flow or regulatory concerns that need to be addressed with a switch to commission based payouts.

Run calculations to determine an amount that most closely mirrors current payouts. Lower payouts may not be taken well by the sales team and could introduce unwanted attrition.

Decide if retention usage holds unique benefits or concerns, and whether commissions should include retained customers signing on to new contracts at the same rate, a different rate, or at all.

Did we miss some of your key questions or concerns? Tell us, and we can work with you to build a compensation plan that works for your goals. Kita brings unique experience to the world of commission planning not found in any other firm and can help your company with its most difficult challenges in Sales Operations and Commission planning.